Condo Insurance in and around Freeland

Unlock great condo insurance in Freeland

Condo insurance that helps you check all the boxes

Welcome Home, Condo Owners

Committing to condo ownership is a big responsibility. You need to consider location needed repairs and more. But once you find the perfect condo to call home, you also need fantastic insurance. Finding the right coverage can help your Freeland unit be a sweet place to call home!

Unlock great condo insurance in Freeland

Condo insurance that helps you check all the boxes

Why Condo Owners In Freeland Choose State Farm

Things do happen. Whether damage from hail, smoke, or other causes, State Farm has excellent options to help you protect your condominium and personal property inside against unexpected circumstances. Agent Michael Miner would love to help you develop a policy that is personalized to your needs.

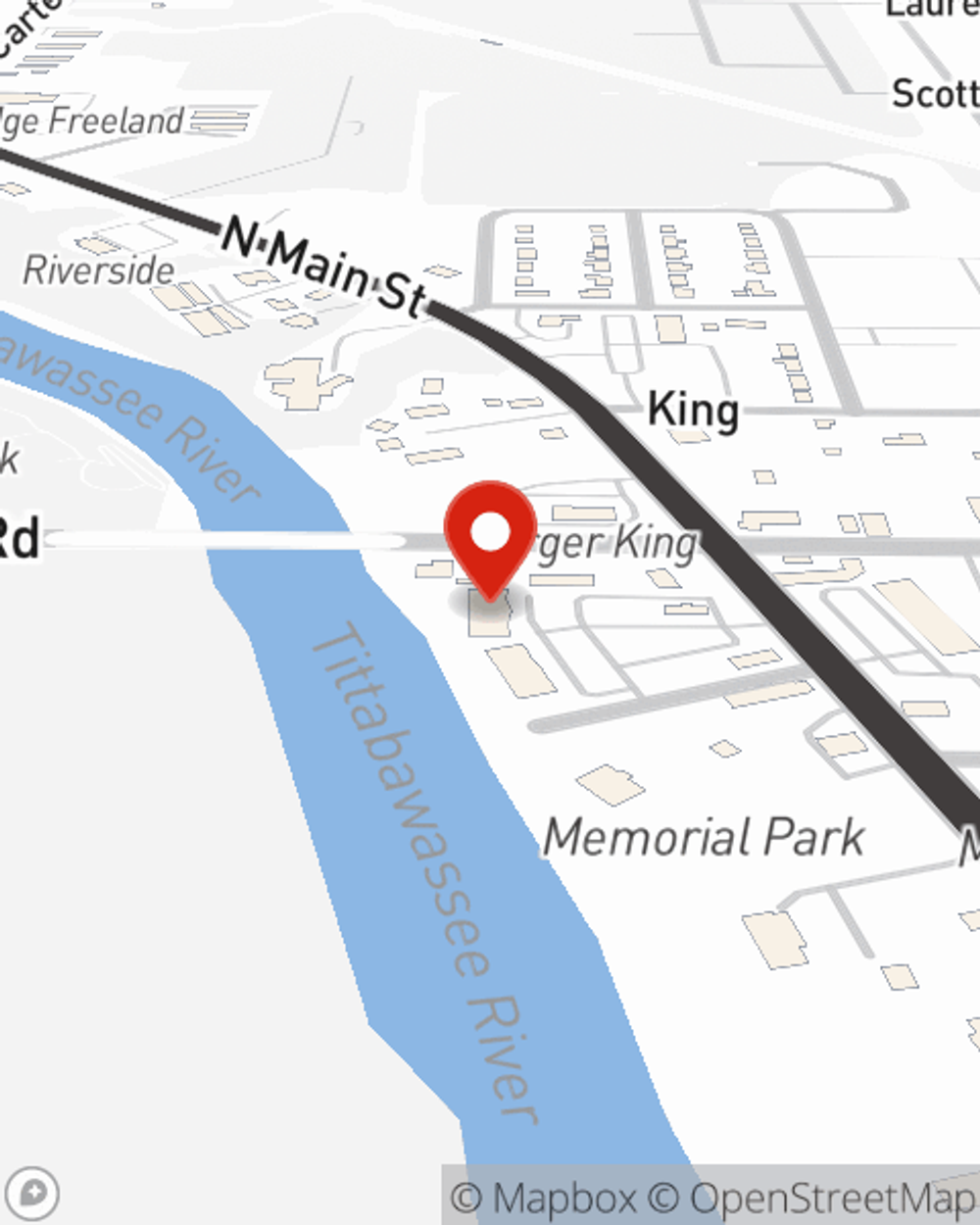

Freeland condo owners, are you ready to explore what the State Farm brand can do for you? Reach out to State Farm Agent Michael Miner today.

Have More Questions About Condo Unitowners Insurance?

Call Michael at (989) 799-2200 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Michael Miner

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.